Non Profit Organizations Near Me - An Overview

Table of ContentsThe 2-Minute Rule for Not For ProfitThe Best Guide To Irs Nonprofit SearchSome Known Questions About Not For Profit.The Basic Principles Of Non Profit Organizations Near Me Getting My Non Profit Organizations Near Me To WorkThe Non Profit Org Statements

While it is safe to say that a lot of charitable companies are ethical, organizations can absolutely deal with several of the very same corruption that exists in the for-profit business globe - 501c3. The Post found that, in between 2008 as well as 2012, more than 1,000 not-for-profit companies checked a box on their IRS Type 990, the income tax return type for excluded organizations, that they had experienced a "diversion" of possessions, meaning embezzlement or various other fraudulence.4 million from purchases connected to a sham business started by a previous aide vice president at the organization. An additional instance is Georgetown University, who endured a considerable loss by an administrator that paid himself $390,000 in added payment from a secret bank account formerly unknown to the college. According to federal government auditors, these tales are all also typical, and function as sign of things to come for those that endeavor to develop as well as run a charitable organization.

In the case of the HMOs, while their "promo of wellness for the advantage of the neighborhood" was considered a philanthropic objective, the court established they did not run mostly to benefit the community by offering wellness solutions "plus" something extra to profit the neighborhood. Hence, the revocation of their excluded condition was supported.

The Definitive Guide to 501 C

There was an "overriding government rate of interest" in prohibiting racial discrimination that outweighed the institution's right to cost-free workout of religion in this way. 501(c)( 5) Organizations are labor unions as well as agricultural and gardening organizations. Labor unions are organizations that create when employees associate to participate in collective bargaining with an employer concerning to salaries as well as benefits.

By comparison, 501(c)( 10) organizations do not offer for settlement of insurance benefits to its participants, and so may organize with an insurer to supply optional insurance coverage without endangering its tax-exempt status.Credit unions as well as other mutual economic companies are identified under 501(c)( 14) of the internal revenue service code, as well as, as component of the banking industry, are greatly managed.

The Buzz on 501 C

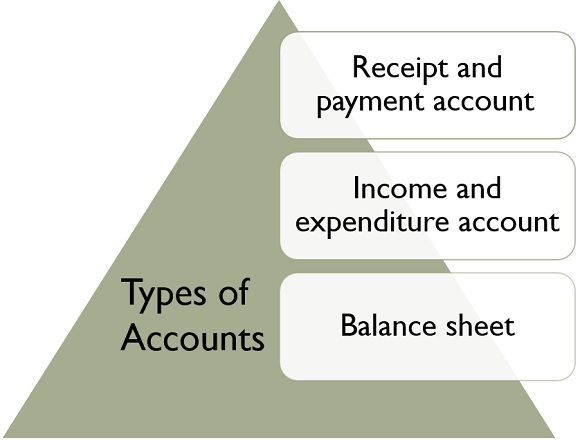

Getty Images/Halfpoint If you're considering beginning a nonprofit organization, you'll wish to comprehend the various sorts of not-for-profit classifications. Each classification has their very own requirements and also conformities. Here are the kinds of nonprofit classifications to help you determine which is right for your organization. What is a nonprofit? A nonprofit is an organization operating to further a social reason or support a common mission.

Provides settlement or insurance to their members upon sickness or other terrible life events. Membership should be within the same work environment or union. Use subscription charges to support outdoors reasons without payment to participants. Establish and manage teachers' retirement funds.: Exist solely to assist in the funeral proceedings for members.

g., online), also if the not-for-profit does not directly solicit contributions from that state. Additionally, the IRS needs disclosure of all states in which a nonprofit is registered on Kind 990 if the sites nonprofit has income of even more than $25,000 each year. Fines for failing to sign up can consist of being compelled to repay donations or facing criminal costs.

The Main Principles Of Non Profit Organizations Near Me

com can assist you in registering in those states in which nonprofit sector you mean to get contributions. A not-for-profit company that gets considerable portions of its income either from governmental resources or from direct contributions from the public might certify as an openly supported organization under section 509(a) of the Internal Earnings Code.

Due to the complexity of the laws and guidelines regulating classification as an openly supported organization, include. com recommends that any type of nonprofit curious about this designation look for legal and tax advice to give the needed guidance. Yes. The majority of individuals or groups develop nonprofit companies in the state in which they will primarily run.

A not-for-profit firm with organization places in several states may form in a single state, after that sign up to do organization in various other states. This suggests that not-for-profit firms have to formally register, submit yearly reports, and pay yearly charges in every state in which they conduct service. State regulations require all not-for-profit companies to keep a registered address with the Assistant of State in each state where they work.

Not known Facts About Non Profit

For instance, area 501(c)( 3) charitable companies may not intervene in political projects or perform significant lobbying activities. Seek advice from an attorney for more certain details canva for nonprofits concerning your company. Some states just need one supervisor, however most of states require a minimum of three supervisors.

A company that serves some public objective and therefore appreciates unique treatment under the legislation. Not-for-profit corporations, in contrast to their name, can make an earnings however can not be developed mainly for profit-making. When it concerns your business framework, have you considered arranging your endeavor as a not-for-profit company? Unlike a for-profit company, a nonprofit may be eligible for certain benefits, such as sales, residential property as well as income tax exemptions at the state level (not for profit).

9 Simple Techniques For Irs Nonprofit Search

With a not-for-profit, any cash that's left after the company has paid its expenses is put back right into the organization. Some types of nonprofits can get contributions that are tax obligation insurance deductible to the person who contributes to the company.